In recent years, the rise of the gig economy has revolutionised the way people work. Freelancers, small business owners, and sole traders now have greater flexibility and autonomy over their careers.

However, this newfound freedom also comes with legal considerations and challenges. As a freelancer, it’s crucial to navigate the legal landscape in such a way that you protect your rights, ensure compliance with employment laws, and establish a solid foundation for your business.

So, let’s explore the key aspects of freelance employment law that you need to be aware of, including some practical tips and guidance to help you thrive in the gig economy.

Understanding Your Employment Status: Independent Contractor Versus Employee

One of the fundamental aspects of freelancing is understanding your employment status. In many jurisdictions, freelancers are classified as independent contractors rather than traditional employees. This distinction is crucial, as it determines the rights and obligations that govern your working relationship with clients.

Independent Contractor

As an independent contractor, you are considered self-employed and responsible for managing your own business. This means you have more control over your work, including setting your rates, choosing clients, and determining your work schedule.

There is a raft of benefits associated with being an independent contractor, rather than an employee:

- Greater Flexibility and Autonomy: As a contractor, you have the freedom to choose your projects, clients, and work schedule. You have more control over your career and the ability to take on diverse projects that align with your skills and interests.

- Increased Earning Potential: Contractors often have the opportunity to set their rates and negotiate fees with clients. This allows for the potential to earn more than traditional employees, especially if you have specialised skills or experience.

- Variety of Work: Contracting offers the opportunity to work on a wide range of projects and with different clients. This variety can keep your work engaging and challenging, providing continuous learning opportunities and expanding your professional network.

- Tax Advantages: Contractors typically have more tax advantages than employees. Depending on your jurisdiction, you may be able to deduct business-related expenses, such as equipment, office space, travel, and professional development, reducing your taxable income.

- Entrepreneurial Opportunities: Being a contractor allows you to develop and run your own business. This entrepreneurial aspect can be fulfilling for individuals who have a passion for building and managing their own brand, reputation, and client base.

- Work-Life Balance: Freelancers often have more flexibility in managing their work-life balance. They can choose when and where to work, allowing for greater control over personal commitments and responsibilities.

It’s important to note that while being a contractor offers these advantages, it also comes with responsibilities, like managing your own taxes, obtaining all the necessary insurances, and actively seeking clients and projects. Additionally, contractors may not receive the same benefits and protections as traditional employees, like superannuation and paid leave.

Employee

Traditional employees, on the other hand, work under the direct control and supervision of an employer. They are entitled to certain benefits and protections, such as minimum wage, paid leave, and social security contributions.

Much like being an independent contractor, there is a raft of benefits associated with being an employee:

- Predictable Income: Employees typically have a steady income with predictable paychecks. They receive a regular salary or hourly wage, providing financial stability and security.

- Employee Benefits: Companies often offer a range of benefits to their employees, like superannuation, annual leave and sick pay, as well as additional perks like training budgets and gym memberships.

- Legal Protections and Rights: Employees are protected by various employment laws that outline their rights and provide safeguards against unfair treatment. These laws may cover areas such as minimum wage, overtime pay, workplace safety, anti-discrimination, and protection against wrongful termination.

- Social Support and Collaboration: Being an employee often involves working as part of a team or within a larger organisational structure. This provides opportunities for collaboration, peer support, and a sense of belonging within a professional community.

- Employer-Paid Taxes and Benefits: As an employee, your employer is responsible for withholding and remitting taxes on your behalf, such as income tax and Medicare.

- Employment Security: Employees generally have greater job security compared to contractors. They are protected by labour laws and have legal recourse in case of wrongful termination or unfair treatment. Employers may also provide notice periods or severance packages in the event of job loss.

Key Employment Law Considerations for Freelancers

There are several key considerations and practical tips to keep in mind to navigate the freelance employment law landscape successfully.

Written Contracts

Always have written contracts in place for your freelance projects. Contracts should clearly define the scope of work, payment terms, deliverables, timelines, and any intellectual property rights. These agreements protect both parties and provide clarity in case of disputes.

Intellectual Property

Understand the ownership and licensing of intellectual property rights. Clearly state who retains ownership of any created works, and whether you grant your clients a license to use your work for specific purposes.

Payment Terms and Invoicing

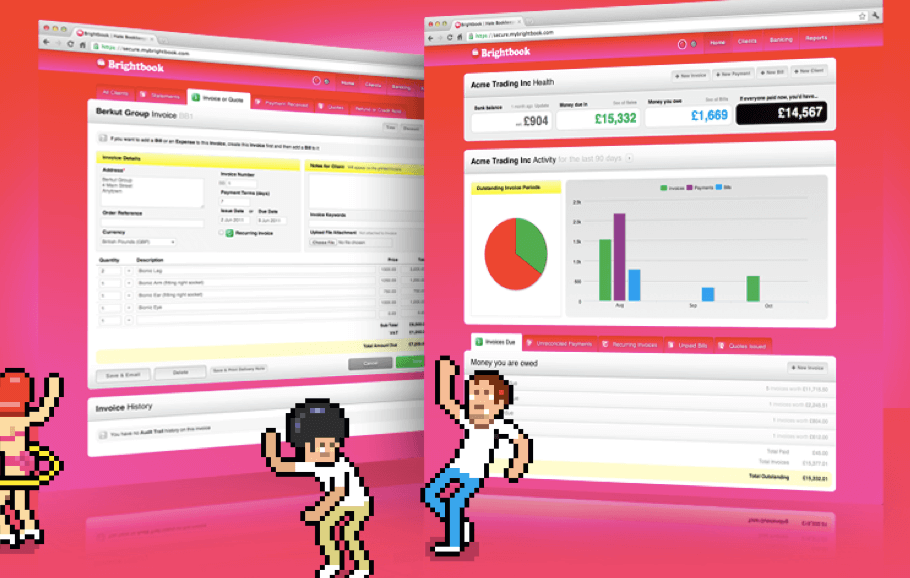

Establish clear payment terms in your contracts, including the agreed-upon rates, payment schedule, and any late payment fees. Promptly send detailed invoices for your services to ensure timely and accurate payments.

Tax and Legal Obligations

Familiarise yourself with the tax and legal obligations specific to freelancers in your jurisdiction. Understand the reporting and payment requirements for income taxes, sales taxes, and any other applicable obligations.

Liability and Insurance

Consider obtaining professional liability insurance to protect yourself from potential claims arising from your work. Consult with an insurance professional to determine the appropriate coverage for your specific freelance activities.

Confidentiality and Non-Disclosure

When handling sensitive information or proprietary data, use confidentiality and non-disclosure agreements to protect both your clients’ and your own interests. Clearly define what information is considered confidential and the obligations of both parties regarding its protection.

Dispute Resolution

Include dispute resolution mechanisms in your contracts, such as mediation or arbitration clauses. These mechanisms can help resolve conflicts more efficiently and cost-effectively than resorting to litigation.

Understanding the Legal Landscape

As a freelancer in the gig economy, understanding the legal landscape is essential for building a successful and sustainable business. By familiarising yourself with your employment status, establishing clear contracts, protecting your intellectual property, and complying with tax and legal obligations, you’re well on your way to success.

Just remember: it’s always best to seek professional advice from a freelance employment lawyer, as laws and regulations can vary based on your jurisdiction. With a solid understanding of gig economy employment law and proactive legal compliance, you can thrive as a freelancer, focusing on what you do best and achieving your professional goals in the dynamic world of the gig economy.