Tips for Maintaining Cash Flow and Financial Stability as a Freelancer

It’s beyond frustrating! You’ve done the work, hit every deadline, the client is happy – but they haven’t paid you. Grrr! 🤬

Late payment of invoices is a common issue faced by freelancers, which can have a significant impact on cash flow and financial stability. It’s not a subject many people enjoy dealing with. At Australia’s Freelancing Hub, we want to address this problem by identifying the issues faced by freelancers, propose effective solutions, and provide guidance on diplomatically asking for payment.

The Problem with Late Payments

Freelancers often encounter late payments, leading to several problems such as inconsistent payment schedules, lack of clear payment terms, and clients disputing invoices.

Here are five common issues caused by late payments:

- Cash Flow Problems: Late payments from clients can create cash flow issues for freelancers. This can hinder the ability to cover operational costs, pay sub-contractors, and invest in financial growth

- Strained Relationships: Late payments can strain relationships between freelancers and their suppliers or service providers. Consistently paying late can damage trust and make it difficult to maintain healthy business partnerships

- Increased Financial Costs: Late payments may result in penalties, fees, or higher interest rates imposed by creditors or lenders. These additional costs can add up over time and impact your bottom line

- Negative Credit Impact: Late payments can negatively impact credit scores. This can make it harder to obtain credit in the future, secure favourable loan terms, or qualify for lower insurance premiums

- Time and Resources Wasted: Chasing late payments requires freelancers to spend additional time and resources on collections efforts. This can divert attention from other important tasks and impact overall productivity

Solutions to Prevent Late Payments

Freelancers need to establish clear payment terms, communicate expectations, and follow up promptly on overdue payments to mitigate these problems caused by late payments.

Clear and Concise Contracts

The importance of having a legally binding contract to protect freelance professionals cannot be emphasised enough!

Having a well-drafted contract with explicit payment terms, up-front deposits, deadlines, and penalties for late payment is crucial. Your freelance contract must include clear language specifying the scope of work, determining payment details, including termination and confidentiality clauses, and obtaining electronic signatures.

For a detailed guide on how to write a freelance contract refer to Top Tips For Writing A Freelance Contract.

Prompt Invoicing and Follow-Up

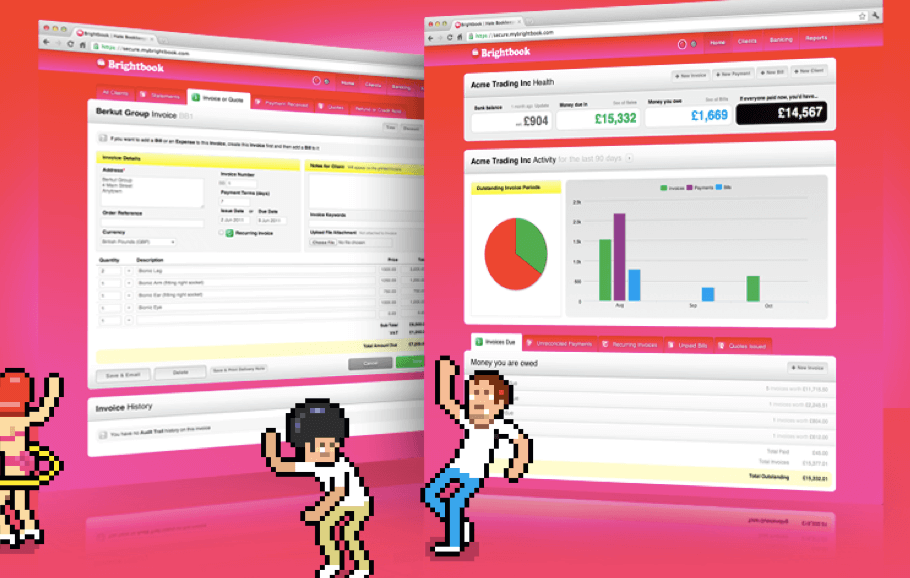

Promptly sending invoices after completing work and setting up a follow-up system for overdue payments can prevent delays. Online tools or invoicing software for streamlined, automatic reminders can be employed.

Discover more about How To Invoice Clients as a Freelancer.

Building Strong Client Relationships

Fostering positive relationships with clients is key. This involves open communication, mutual respect, and maintaining professionalism. Advice on maintaining professional yet assertive communication to ensure timely payments without damaging client relationships is discussed in Building Client Partner Relationships as a Freelancer.

Late Payment Fees

Implementing incentives, such as early payment discounts, can motivate clients to make prompt payments. This can help them avoid late fees and other penalties, as well as improve your cash flow. You can also use incentives to encourage clients to pay their invoices in full, rather than just a portion of the total amount due.

Diplomatically Asking for Payment

Create a strategy for requesting payment diplomatically and professionally. This can include sending friendly email reminders, using polite language, and setting boundaries. If you establish your payment schedule expectations in your contract, you can simply remind your client of what they have already agreed to, without the need for negative inference – simply redirect them back to your agreement.

Value your Work

The subject of money will always be taboo: ironic in an age of oversharing! 🙃

Always remain polite and professional, but the smart move is to emphasize your terms upfront before any work is done and the sticky subject of late payments has not arisen.

Get an upfront deposit! Not only do you protect yourself financially, but clients take you seriously. You establish yourself as professional from the outset.

We understand this is never going to be an easy conversation, but we do hope the suggested strategies help freelancers mitigate the risk of late payment and ensure a healthy cash flow in their freelance careers.

- Tax Return for Australian Freelancers: A Practical Guide - 02/04/2025

- Cost of Living Crisis: Strategies for Freelance Rate Increase - 15/11/2024

- Cybersecurity Precautions for Digital Nomads - 15/07/2024